estate tax change proposals 2021

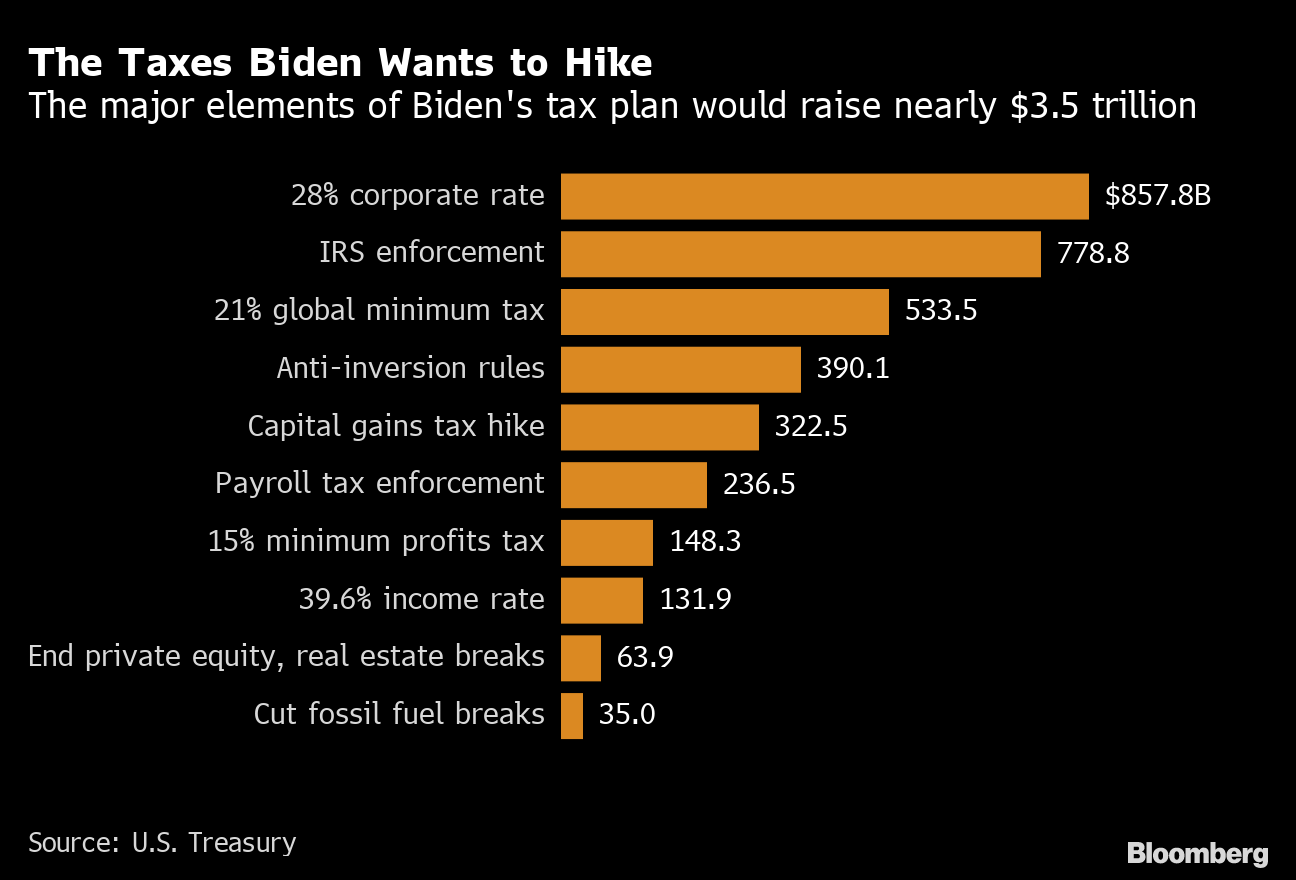

Web Back in the autumn of 2021 Democrats had proposed significant changes to the federal income tax code. Web Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US.

Property Taxes Property Tax Analysis Tax Foundation

Detailed Tax Payment Information Go to the History section and click on Tax Year Only tax payments made after September 1 2010 are displayed on.

. Web New Real Estate Info System System updated monthly. 2022 Proposed Reassessment Value Changes 19MB Please help us make these systems work better for you by providing feedback on your experience and reporting any problems you may find. Web Compare the best Tax Planning software of 2022 for your business.

Web Pay Property Taxes Real estate taxes are paid one year in arrears. Real Estate Info System Information for years 2018 and earlier. In the year 2023 property owners will be paying 2022 real estate taxes.

Change the Payoff Month Enter desired monthyear and click on Submit. Being chosen as a Finalist in the 2021 CPA Practice Advisors Technology Innovation Awards. Real estate tax notices are mailed to the property owners in either late December or early January.

Clerk of Courts Banking Services. Find the highest rated Tax Planning software pricing reviews free demos trials and more. In response to these proposals we wrote a blog post last September on the slow death of the S.

Natural Hazards Mitigation Plan Professional Services Contract. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a. It also contains no changes to the basis step-up rules for inherited assets no change to the unified giftestate tax credit and no.

40 2022 1206 million. Web The City of Milwaukee offers a variety of properties for sale including fully rehabilitated homes tax-foreclosed buildings vacant lots surplus municipal facilities and brownfield properties suitable for redevelopment. Today only localities 10 at the time of writing levy excise taxes on sugary drinks in the US but that could change.

Taxes Due Go to the History section and you will see a break down by tax year. Web A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets. The first half of your real estate taxes are due by midnight on April 30th.

This comment explores the various proposals Congress has considered with a special emphasis on the interaction of estate tax on state revenue and philanthropy. Foodservice for the Franklin County Juvenile Intervention Facility. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would.

Web In 2021 the deal space was robust with over C188 billion in real estate property transactions over C40 million occurring throughout the year representing a significant jump from 2020. Web RFP 2021-48-06. Explore the Housing Help tool to find housing resources you can use if youre a homebuyer homeowner or investor.

Including being named one of Accounting Todays Top New Products of 2021. Web Go to Print tax bills section Click on Tax Year. Web The estate tax in the United States is a federal tax on the transfer of the estate of a person who dies.

Web After a few years without much attention taxes on sugar-sweetened beverages SSBs are back in the headlines with at least four statesConnecticut Hawaii New York and Washingtonconsidering such statewide taxes.

Us Infrastructure Bill Does Not Include 61 Percent Estate Tax Fact Check

Reasons Why You Might Want To Pay Your Points On Your Mortgage Financial Education Personal Finance Financial Literacy

Income Tax Law Changes What Advisors Need To Know

Property Taxes Property Tax Analysis Tax Foundation

Tax Proposals Comparisons And The Economy Tax Foundation

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Estate Tax Law Changes What To Do Now

Democrats Might Not Touch These Taxes But They Re Going Up Anyway

Tax Proposals Comparisons And The Economy Tax Foundation

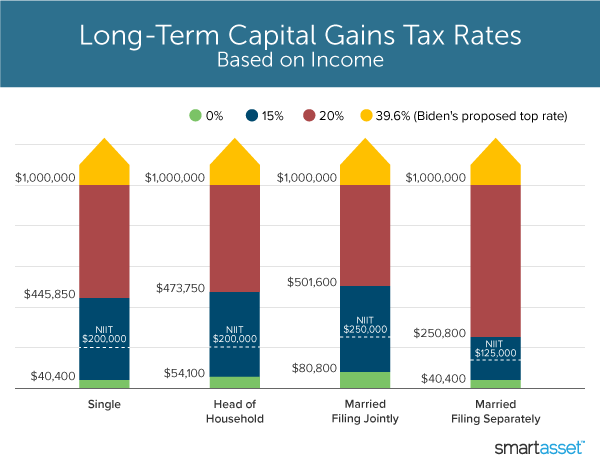

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

State Death Tax Hikes Loom Where Not To Die In 2021

Outsourcing Services Templates Designs Docs Free Downloads Template Net Contract Template Business Management Separation Agreement Template

What S In Biden S Capital Gains Tax Plan Smartasset

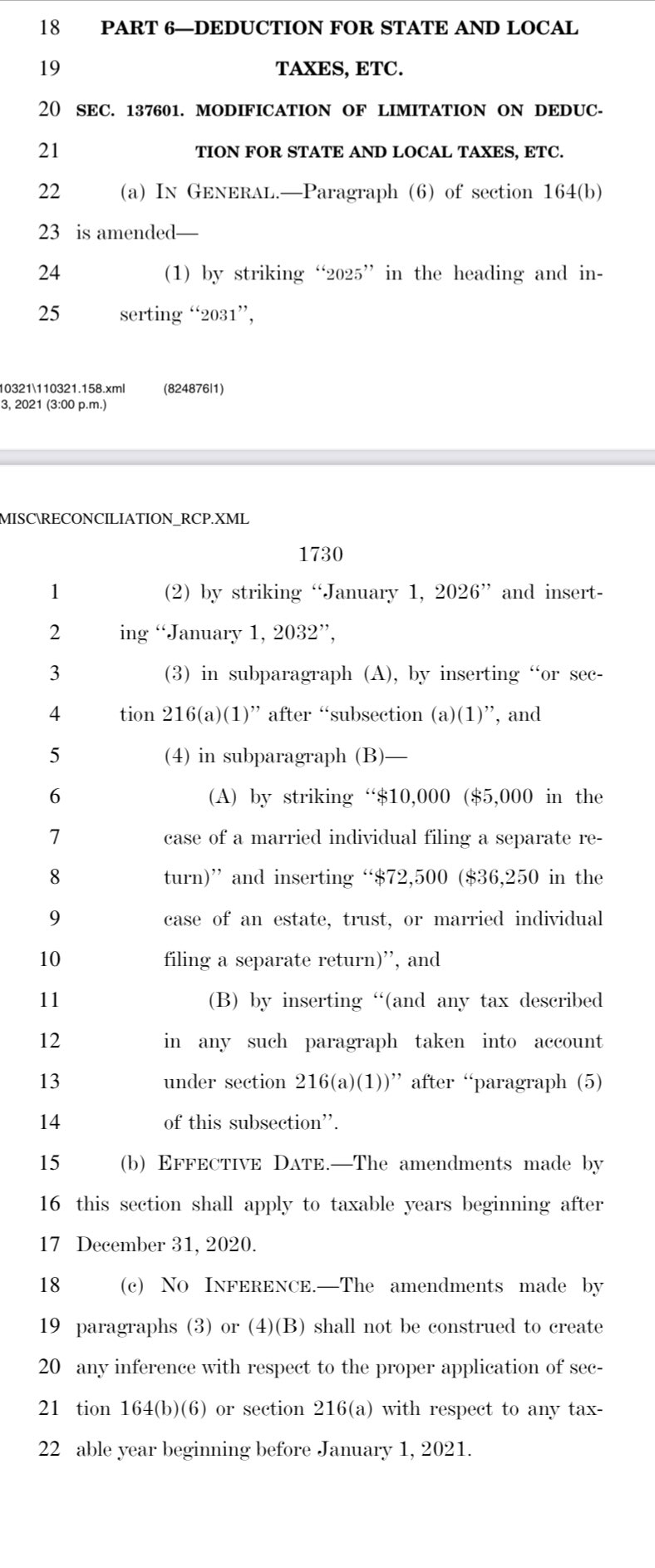

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra